TGN Issuance & Allocation

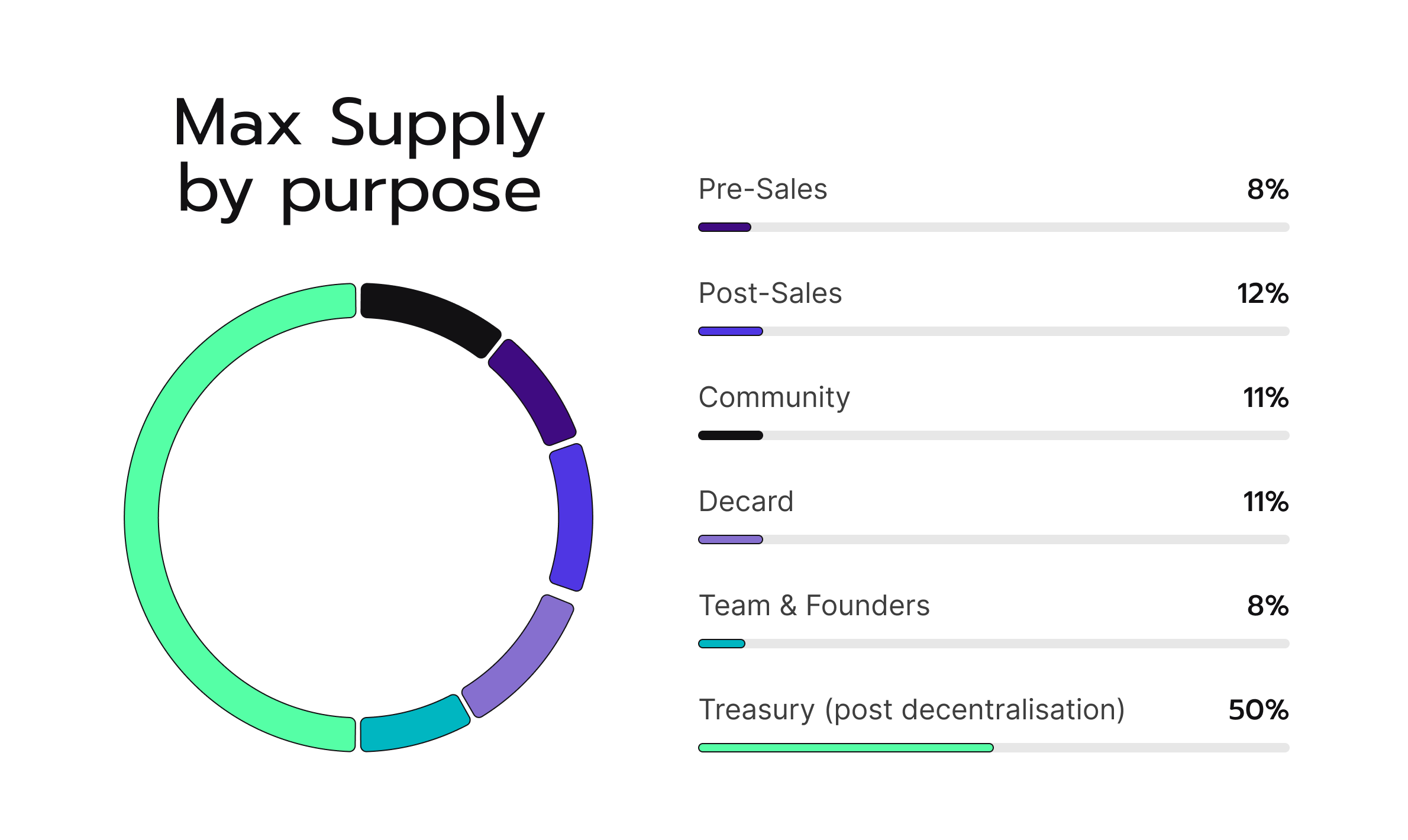

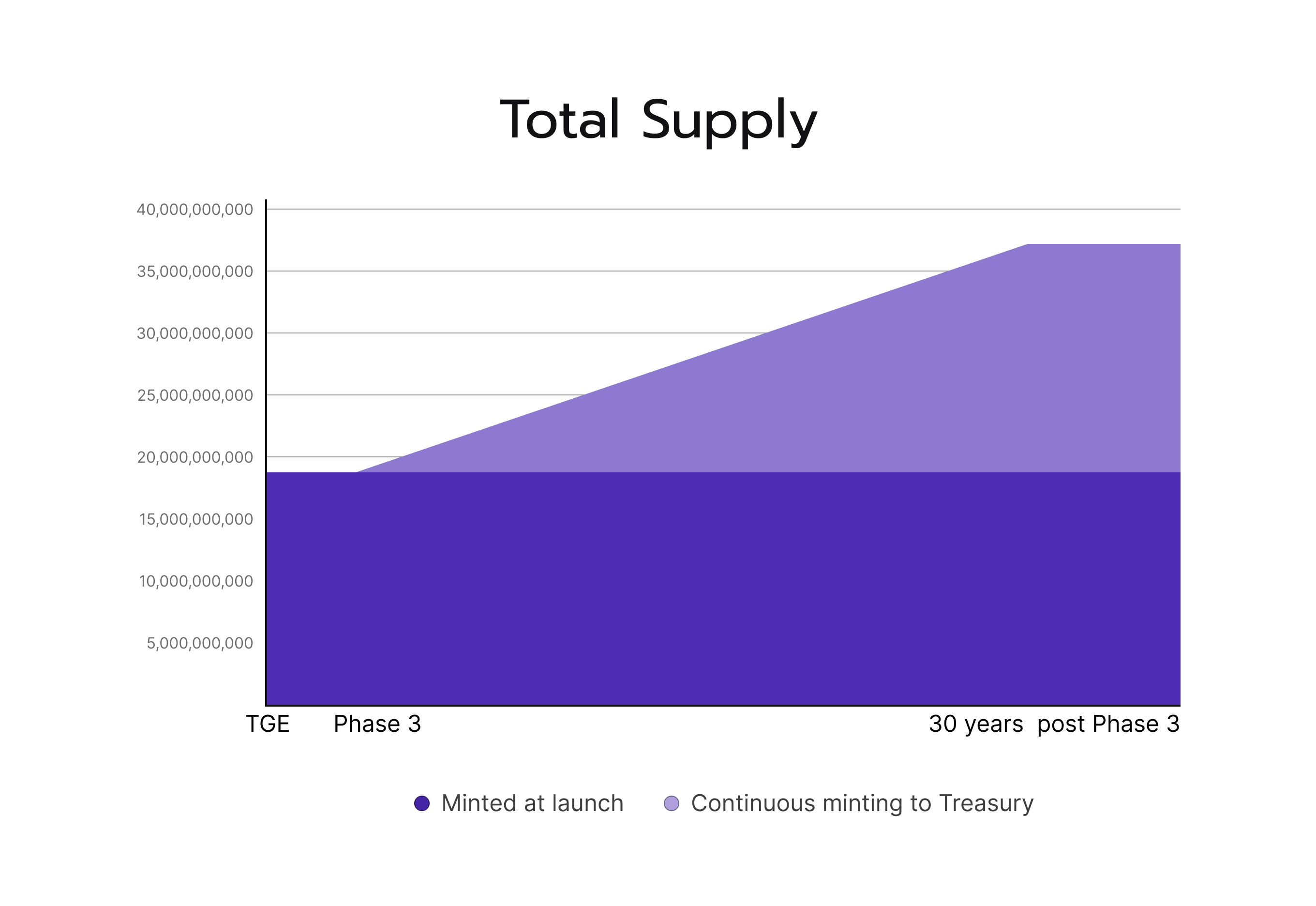

The maximum supply of TGN tokens is currently set to be 37bn1. (See list of definitions below.)

Half of this was minted in what was previously referred to as our “Token Generator Event” (TGE) which happened along with the launch of the Tagion mainnet on Dec 7th 2023.

Minting and Allocations

Most of the 18.5bn TGN minted at the launch of the mainnet have not been issued yet but all are earmarked/dedicated to different purposes in regard to the development of the Tagion network. This is here called the tokens’ “allocation”.

| Allocation: | Amount: |

|---|---|

| To disburse to pre-sale investors: | |

| Sold by Decard Services GmbH (a wholly owned and regulated subsidiary of Decard Group). Revenue from pre-sale went to Decard Group for the development and initial maintenance and advancement of Tagion core infrastructure. | 3.1bn ~ 8.5% of max supply |

| To disburse to post-sale investors: | |

| Continues to be sold by Decard Services GmbH. Revenue goes to Decard (or potentially other services providers) for the ongoing development, maintenance and advancement of Tagion core infrastructure. | 4.4bn ~ 11.5% of max supply |

| To disburse to active Tagion community: (labelled “Ecosystem” in previous version) | |

| To incentivize and reward the wider community, including users, developers, and other key stakeholders. The goal is to foster engagement and participation in ways that enhance the growth, security, and overall well-being of the Tagion Network and its ecosystem. This may encompass direct payments in TGN, airdrops, liquidity provision, grants and more. Once an independent steward entity is established, it can also sell part of this allocation to advance the above purpose in other ways. | 4.0bn ~ 11% of max supply (As of 2025: 27.5Mio were disbursed) |

| To disburse to Decard | 4.0bn ~ 11% of max supply |

| To disburse to team and founders | 3.0bn ~ 8% of max supply |

| Total Current Allocations | 18.5bn ~ 50% of max supply |

The other half of the max supply is scheduled to be minted on a continues bases over a period of approximately 30 years (616 million annually - changes to this schedule can be introduced later by community decision). These tokens will be directly assigned to the then established Tagion Treasury and used, along with other resources, to reward node operators as well as to continuously incentivise community engagement, governance, network maintenance and software upgrades.

This secondary minting process (previously referred to as “emission”) starts once significant advances in decentralising Tagion have been achieved (see Phase 3. Curated Release).

Reporting and Definitions

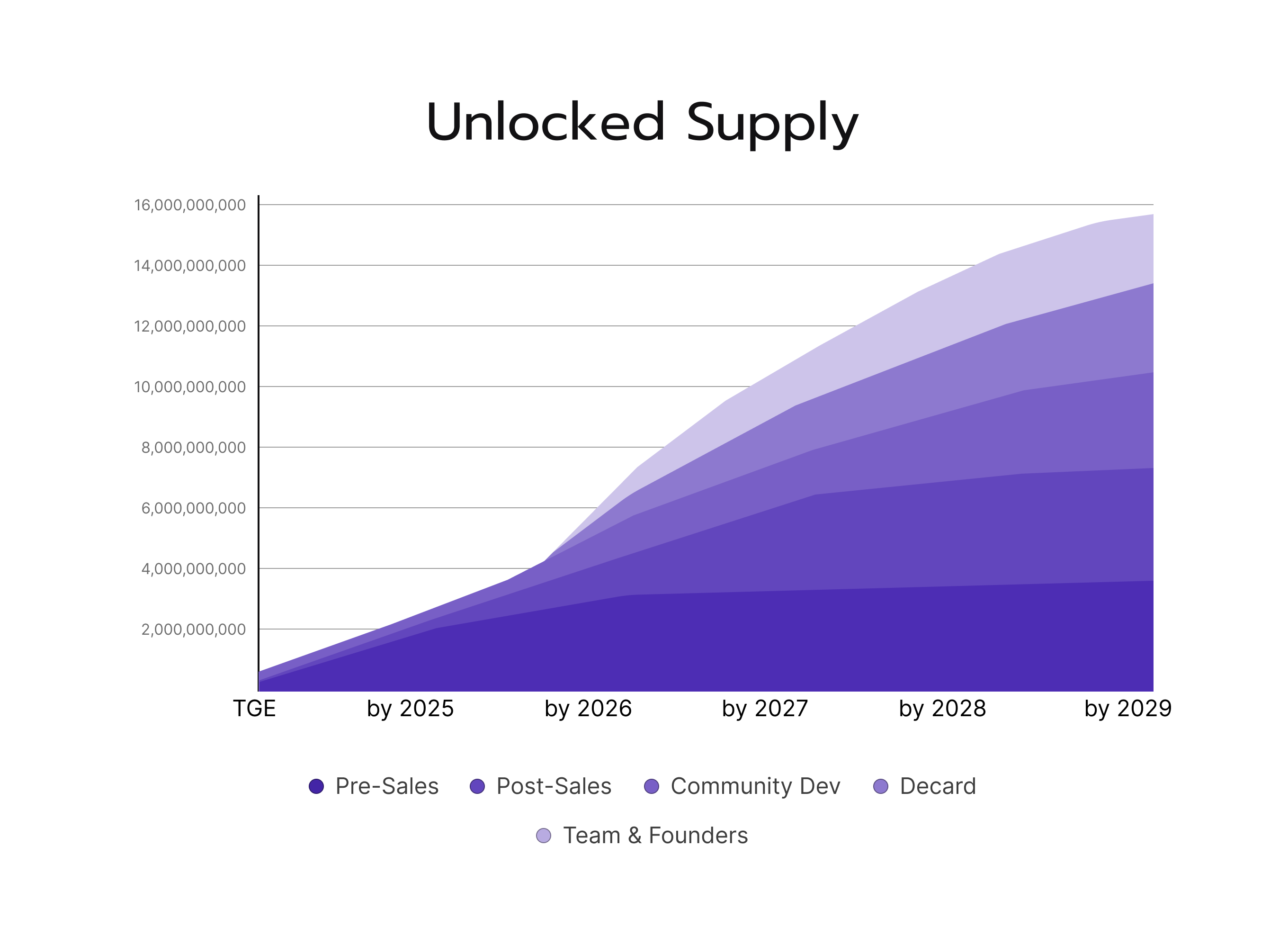

It is important to prevent too many tokens being made available at the same time so that they do not flood the market prematurely and destabilize the token's value.

To achieve this, tokens sold in pre- and post-sales or otherwise assigned are not immediately disbursed to the beneficiaries' JustPay wallets, but held back/locked in the Tagion portal. The time for which assigned tokens are locked is called the “vesting period”.

After this period the unlocked tokens2 can be requested to be paid out in the Tagion portal, we call that their disbursement. Since these requests will typically not happen right after the vesting period ends, we distinguish between the unlocked supply (tokens that can be disbursed) and the circulating supply (tokens that have been disbursed).

| Terminology: | Definition: |

|---|---|

| Max Supply | Currently set upper limit of how many TGN tokens can be minted. |

| Total Supply | Amount of TGN tokens that have been minted at a given moment (fixed to 18.5bn until start of release phase 3). |

| Assigned Supply | Amount of TGN tokens sold to investors (with vesting schedule) or otherwise assigned to individual owners (with or without vesting terms) but not yet disbursed. |

| Unlocked Supply | Amount of TGN tokens that had been assigned and for which all the vesting terms are fulfilled, meaning they are now eligible to be disbursed. |

| Circulating Supply3 | Amount of TGN tokens that have been paid out to individual wallets and can be used or sold on the market. |

If you find other metrics more useful to be reported on, please let us know.

In March 2025 out of the 3,129,452,528 TGN that have been sold (in pre- and post-sales) or assigned to community members, a total amount of 816,151,055 TGN were unlocked for payouts.4

Since disbursements/payouts of unlocked tokens are not automatically initiated at the end of a given vesting period, there is no way of calculating the amount of circulating tokens for the future. But we will report on the actual circulating supply at regular intervals.

In June 2024, when the last “Tokenomics Paper” was published, the circulating supply (then reported without tokens assigned to team and founders) was at 21,700,000 TGN. In March 2025, the circulating supply as defined above is at 132,839,898TGN.

Vesting can be time-based, where tokens are released systematically over a predetermined timeline, event-based, where tokens are released upon achieving specific milestones or events, or price-based, where tokens are released upon achieving a set market price. By predominantly using time-based vesting, the Tagion Network ensures a steady token release into circulation, fostering a predictable token evolution on the supply-side of TGN. This results in an increase in unlocked supply as shown in the graphic below.

Vesting Terms (updated)

The exact vesting rules for different allocations/recipients of TGN tokens are as follows.

a) for Investors

The allocation for investors can be segmented into two categories: those who already have invested in the pre-sale (before the launch of the mainnet on Dec 7th 2023) , and those who have invested since, in the so-called post-sales.

Pre-Sales

At the outset of the Tagion Token Generator Event (TGE – simultaneous with the launch of Tagion mainnet on Dec 7th 2023), 10% of tokens previously purchased by investors were immediately made available. Then, there was a 12-month cliff without any further release of tokens. Following this, 5% of the assigned tokens became available each month. This structure results in a total vesting period of 30 months.

However, the tokens are also subject to price-based vesting, which takes priority over time-based vesting, meaning if the token price reaches certain specified levels in secondary markets (in relation to the introductory price in secondary markets), the tokens will be unlocked ahead of the outlined time schedule: 10% after a 100% price increase, an additional 50% following a 300% increase, and all remaining tokens are released once a 900% increase is achieved, provided each threshold is maintained for at least thirty days.

Post-Sales

Tokens available in post-sales will be offered either through token sales agreements or, eventually, on various exchanges. In the primary market, where tokens are sold via sales agreements, there's no upper limit on the quantity of tokens that can be purchased. These agreements, however, come with vesting terms, which, although negotiable, are expected to generally align with the time-based elements set for pre-sales investors.

Conversely, for tokens sold on exchanges in the secondary market, buyers are not subject to vesting terms. However, Decard Services GmbH has capped this option at a maximum annual sale of 500 million TGN. This structure ensures a balanced and regulated approach to both primary and secondary market transactions, aligning with our broader strategy for sustainable network growth.

b) for active Community Members

These tokens allocated to what was previously called “the Ecosystem” are subject to time-based vesting. When disbursed to community members as incentives or rewards, 20% will be released annually over a five-year period.

c) for Team & Founders

The starting point for the time based vesting of this allocation has been postponed from TGE to release Phase 3.

Then, 20% of the allocation (600 million TGN), come under a time-based vesting schedule (20% right away, cliff period of 18 months, then 5% each month). The total vesting period for this group thus spans over 36 months from the start of release phase 3.

The remaining 80% of this allocation is subject to a combination of event- and price-based vesting conditions. Their vesting will commence after both of the following events have been achieved:

-

Network distribution as described for release phase 3 (curated release).

-

Exchange Listing: The TGN token is successfully listed on an exchange, whether decentralized or centralized.

Thereafter, only when the following price targets are reached and maintaining for no less than 30 consecutive days in a public market, the next 480 million TGN will be unlocked:

at 0.01 EUR, at 0.05 EUR, at 0.1 EUR, at 0.5 EUR, and - for the last time - at 1 EUR.

c) for Decard

Decard is the company founded to be the initial developer, steward and long-term pillar supporting Tagion's establishment and sustainability.

At the time of launching into release phase 3 (curated release), 20% of this allocation will be made available, with another 20% following each consecutive year.

Using TGN Tokens

Once unlocked tokens have been paid out from the online portal into a JustPay wallet, and have thus become part of the "circulating supply" (see definitions here), owners of these tokens can use them in whatever way they like.

This, of course, includes tendering them for the purchase of goods and services, but acceptance of them on part of the provider of those goods and services is purely voluntary.

Currently, as TGN tokens are not yet listed on any token exchange, there is no brokered way of selling them. However, "over the counter" sales are always possible if two parties agree on the price and conditions. All that is technically required is that the recipient has a JustPay wallet into which the tokens can be transferred, and that seller of tokens is confident that he will receive payment as agreed.

As was explained in our Townhall #13 (January 9th 2025, from minute 32 on the recording), the plan is not to consider and pursue being listed on an exchange before we achieve organic demand (or what we call UDD: "Utility Derived Demand") and before the mainnet is running with adequate system stability and resilience, which will happen with Tech Mode 2 and Release Phase 1.

Footnotes

-

This cap is not rigid and can be adjusted through community decision.We foresee two primary scenarios that might justify such an action. Firstly, should there be a shortage of incentives deterring node operators from participating in transaction validation. Secondly, if TGN develops money-like qualities in the future, it may become necessary to implement appropriate monetary policies to maintain economic stability and functionality. ↩

-

This was previously called "vested" or "fully vested" supply, but since that term was sometimes confusing to our users, we now use this more intuitive and descriptive wording. ↩

-

We previously reported on “Circulating Supply” excluding any tokens disbursed to the team, founders and shareholders. While an industry standard for this term seems far off (see here for an example of the current inconsistencies), we are now using the above more inclusively and intuitive definition. ↩

-

In June 2024, unlocked supply was reported to be 1,975,000,000 TGN. This number is higher then the unlocked supply in March 2025 because of the updated vesting terms for the allocations to Decard, team and founders. Those tokens are now locked until the distribution of the network is achieved (start of the release phase 3). ↩